2023 CONTRIBUTION LIMITS AND STANDARD DEDUCTION ANNOUNCED

SUMMARY

Given historic inflation, the IRS has updated the annual contribution limits for every type of retirement account and increased the standard deduction.

INFLATION IMPACTS

In response to the continued rise in inflation, the IRS has adjusted the annual dollar limits an individual can contribute to his or her retirement accounts for 2023.

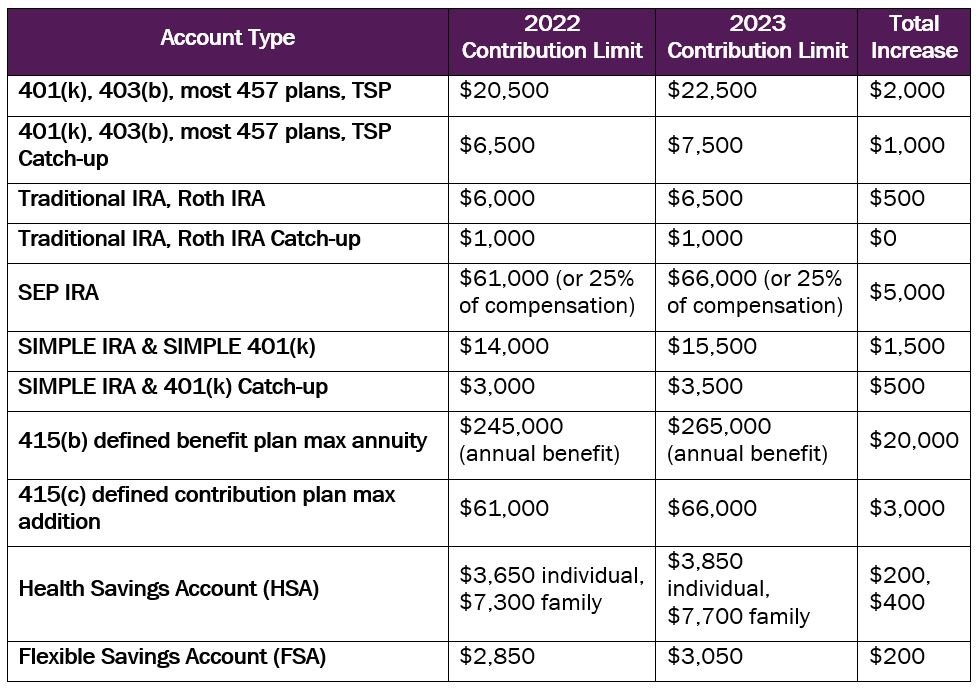

Table 1: 2023 contribution limits as announced by the IRS.

The deductibility phaseout range for IRA contributions will increase to $73,000-$83,000 for individuals and $116,000-$136,000 for those married filing jointly. Meanwhile, the Roth IRA income phaseout range will increase to $138,000-$153,000 for individuals and $218,000-$228,000 for those married filing jointly.

As a reminder, in most cases, 2022 employee contributions to employer plans such as 401(k)s and 403(b)s must be made by December 31, 2022. You can continue to make 2022 contributions to traditional and Roth IRAs until Tax Day, April 17, 2023, and to SEP IRAs until you file your taxes (including any extensions).

TAX DEDUCTIONS

Contribution limits aren’t the only thing rising in 2023. The standard deduction for individual filers has increased $900 from $12,950 to $13,850. For those who are married filing jointly, the deduction will increase from $25,900 to $27,700.

If you have questions about your contributions, please don’t hesitate to reach out.

Natalie Brown, CFP®

Director of Client Services & Financial Planning

Day Hagan Private Wealth

—Written 10.24.2022

Print PDF Copy of the Article: Day Hagan Private Wealth Insights: 2023 Contribution Limits and Standard Deduction Announced (pdf)

Disclosure: The data and analysis contained herein are provided “as is” and without warranty of any kind, either express or implied. Day Hagan Private Wealth (DHPW), any of its affiliates or employees, or any third-party data provider, shall not have any liability for any loss sustained by anyone who has relied on the information contained in any Day Hagan Private Wealth literature or marketing materials. All opinions expressed herein are subject to change without notice, and you should always obtain current information and perform due diligence before investing. DHPW accounts that DHPW or its affiliated companies manage, or their respective shareholders, directors, officers and/or employees, may have long or short positions in the securities discussed herein and may purchase or sell such securities without notice. The securities mentioned in this document may not be eligible for sale in some states or countries, nor be suitable for all types of investors; their value and income they produce may fluctuate and/or be adversely affected by exchange rates, interest rates or other factors.

Investment advisory services offered through Donald L. Hagan, LLC, a SEC registered investment advisory firm. Accounts held at Raymond James and Associates, Inc. (member FINRA, SIPC) and Charles Schwab & Co., Inc. (member FINRA, SIPC). Day Hagan Asset Management and Day Hagan Private Wealth are both dbas of Donald L. Hagan, LLC. None of the entities listed here in this disclosure are affiliated.